Whether you’re new to Medicare, getting ready to turn 65, or preparing to retire, you’ll need to make several important decisions about your health coverage. The first thing to do is go online to the Medicare website and learn about the A, B, C and Ds of Medicare coverage plans.

The different parts of Medicare help cover specific services:

- Part A (hospital insurance): Helps cover:

– Inpatient care in hospitals,

– Skilled nursing facility care,

– Hospice care,

– Home health care. - Part B (medical insurance): Helps cover:

– Services from doctors and other health care providers,

– Outpatient care,

– Home health care,

– Durable medical equipment (such as wheelchairs, walkers, hospital beds, etc.),

– Many preventive services (such as screenings, shots, vaccines and annual wellness visits). - Part C (Medicare advantage): Offers a bundled package that includes Parts A and B, and usually Part D.

- Part D (Prescription drug coverage): Helps cover the cost of prescription drugs (including many recommended shots or vaccines).

Original Medicare includes Parts A and B.

Reminder if you wait to enroll, you may have to pay a penalty, and you may have a gap in coverage.

Medigap is extra insurance that you can buy from a private company that helps fill in the “gaps” in Original Medicare – such as copayments, coinsurance and deductibles. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Click here to learn more about Medigap.

COST

Original Medicare doesn’t pay any of the costs for you to get a Medigap policy. You have to pay the premiums for a Medigap policy. Insurance companies may charge different premiums for the same exact policy. Be sure you’re comparing the same policy. For example, compare Plan A from one company with Plan A from another company.

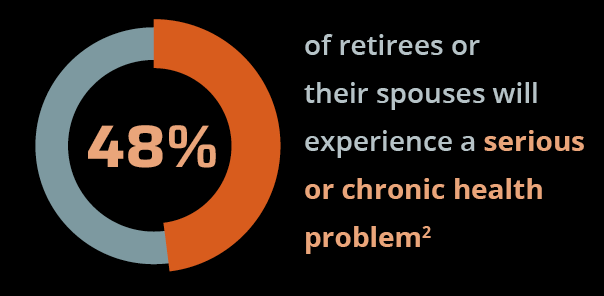

It might be hard to imagine now, but chances are you’ll need some help taking care of yourself later in life. The big question is: How will you pay for it?

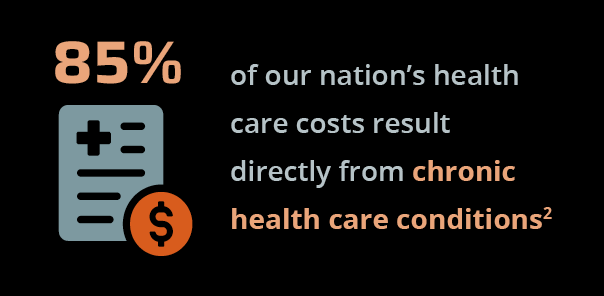

Buying long-term care insurance is one way to prepare. Long-term care refers to a host of services that aren’t covered by regular health insurance. This includes assistance with routine daily activities, like bathing, dressing or getting in and out of bed.

A long-term care insurance policy helps cover the costs of that care when you have a chronic medical condition, a disability or a disorder such as Alzheimer’s disease. Most policies will reimburse you for care given in a variety of places, such as:

- Your home

- A nursing home

- An assisted living facility

- An adult day care center

Regular health insurance and Medicare do not cover long-term care. Medicare only covers short nursing home stays or limited amounts of home health care when you require skilled nursing or rehab only. It doesn’t pay for custodial care, which includes supervision and help with day-to-day tasks.

NEARLY 70% OF 65-YEAR-OLD PEOPLE WILL NEED LONG-TERM CARE SERVICES OR SUPPORT. WOMEN TYPICALLY NEED CARE FOR AN AVERAGE OF 3.7 YEARS, WHILE MEN REQUIRE IT FOR 2.2 YEARS.3

KEY TAKEAWAYS:

- Use myOrangeMoney4 to model your retirement

- Go to the Medicare website to learn more

- Play “what if” and evaluate all of your options

- Meet with a financial professional if you don’t want to do it alone

- Ask a financial professional about what else you can do to make the most of your health care options in your financial plans

- https://www.ebri.org/docs/default-source/ebri-issue-brief/ebri_ib_549_savingstargets-13jan22.pdf?sfvrsn=67983b2f_2

- https://www.cdc.gov/chronicdisease/about/costs/index.htm

- https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

- IMPORTANT: The illustrations or other information generated by the calculators are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. This information does not serve, either directly or indirectly, as legal, financial or tax advice and you should always consult a qualified professional legal, financial and/or tax advisor when making decisions related to your individual tax situation.

The information contained on this website is intended to summarize at a high level some of the provisions under the Trinity Industries, Inc. 401(k) Plan (the “Plan”). It is not intended to provide a full description of the Plan. In the event of a conflict between the official Plan document and this website, the official Plan document is controlling.

Plan administrative services provided by Voya Institutional Plan Services, LLC (VIPS), a member of the Voya® family of companies.

© 2024 Voya Services Company. All rights reserved.