A retiree’s largest source of income is typically accumulated retirement savings. This may include your Trinity Industries, Inc. 401(k) Plan (the “Plan”) account, traditional and/or Roth IRAs, and any pension or savings plan accounts from all prior employers for you or your spouse/partner.

Plan distribution options

- Lump sum: you may choose to receive a lump-sum payment equal to the entire balance of your vested account in the Plan.

- Installment payments: you may choose to receive your money in equal installment payments over a certain term (not to exceed your life expectancy).

- Direct rollover: you may be eligible to elect a direct rollover of your distribution to an IRA or another qualified plan, to avoid current taxation of your benefit.

THINGS TO CONSIDER

- If you are under age 59½, taking a distribution other than a rollover could require you to pay taxes and penalties. Mandatory 20% federal income tax withholding will be applied, in the year of distribution, to distributions eligible for rollovers that are not directly rolled over. State tax withholding will be applied as required by your state of residence.

- If you are under age 59½ and do not do a rollover, you will also have to pay a 10% additional income tax on early distributions (unless an exception applies).

- After you stop working, you can keep your savings in the Plan if your account balance is greater than $7,000, up to age 73 when the law requires minimum distributions (RMD) to begin.*

*Applies to any individual who attains age 72 after December 31, 2022, and age 73 before January 1, 2033, and for any individual who attains age 74 after December 31, 2032. If you turned 72 in 2022 or earlier, your RMDs will continue as scheduled.

Visit the Social Security Administration’s website to confirm the age at which you can receive full benefits. You can begin taking reduced benefits at age 62, but you may want to wait until you are eligible for the full benefit amount at your Full Retirement Age. Or you can choose to wait until after you have reached your Full Retirement Age to collect an even higher Social Security benefit.

SOCIAL SECURITY GUIDANCE

To help you optimize your payments based on your savings, check out Voya Retirement Advisors’ Social Security Guidance1 tool, available to you through Voya Retirement Advisors investment advisory services.2 This free guidance compares different Social Security strategies and provides clear steps to put guidance into action.

- Log in to your Plan account and click Get Investment Advice at the top of the page.

- Follow the You Do The Work path (unless you want to enroll in Professional Managed Accounts) until you land on the Overview tab, then click on the Income Planner tab to begin using Social Security Guidance.

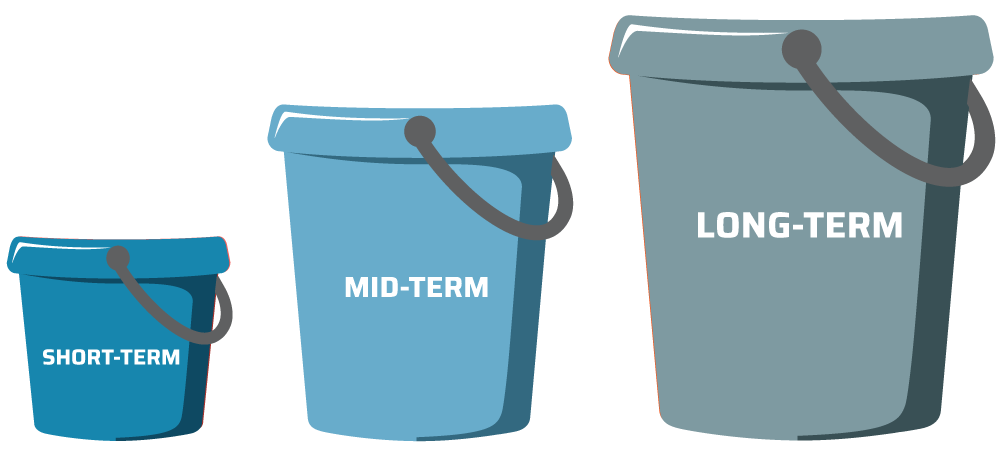

Over the course of your lifetime, you have probably accumulated personal savings outside of the Trinity Industries, Inc. 401(k) Plan. In general, personal savings can be categorized into three “buckets”: short-term, mid-term and long-term.

Short-term savings

This bucket is meant to provide two years’ worth of retirement income and is funded with low-risk assets. These assets are unlikely to yield meaningful returns, but their reliability is what counts. The following fall into this category:

- Savings accounts

- Certificate of Deposits (CDs)

- Short-term bonds

- Money market accounts

The short-term bucket is all about liquidity and should allow you to meet your income needs without worrying about what’s going on in the market. When this bucket begins running low, the idea is to replenish it with investment returns, dividends and interest income from your other two buckets.

Mid-term savings

This bucket is dedicated to income you’ll need three to seven years from now. Its function is to create both income and stability. The risk level here is medium. Playing it too safe can make it difficult to keep pace with inflation and being too risky could result in losses that impact your ability to meet your income needs. Assets in this bucket include:

-

CDs

-

Longer-term bonds

- Growth and income mutual funds

Returns generated from this bucket can be used to replenish your short-term bucket as needed.

Long-term savings

Devoted to growth, this bucket is earmarked for high-risk investments that will help you beat inflation over the long haul. That describes volatile assets that are likely to go up and down in value during the short term – but hopefully net meaningful returns over the next decade and beyond. This includes:

-

Individual stocks

-

Real estate

- Personal brokerage accounts

As income is generated from these investments, retirees can top off their intermediate bucket.

The bucket strategy is one way to manage your income when you’re no longer working. If the style resonates with you, it can provide stability and allow you to grow your portfolio during retirement. Rebalancing your portfolio at least once a year is recommended.

Some of the most effective ways to increase retirement income is to work a year or two longer, or to take a part-time job to supplement your income in the early years of retirement. If you plan to keep working – either full time or part time – during your retirement years, check with the Social Security Administration to see if employment will affect your benefits

DRAW-DOWN STRATEGY

Your “draw-down strategy” is a plan for how to turn your assets into income that will last for life. It can be just as important as when you retire or how much you withdraw. Numerous studies suggest that if you follow a disciplined withdrawal plan, your savings have a good chance of providing income for 30 years or longer. A rule of thumb is to start by withdrawing no more than 4% of your retirement savings in the first year of retirement.

All investing involves risk, including loss of principal. When sold, an investment may be worth more or less than the original investment amount. Rebalancing does not ensure a profit nor guarantee against loss in a declining market.

-

Edelman Financial Engine’s Social Security guidance can provide reasonable estimates that are not guarantees of future benefit payments. All estimates are based upon information about you, your stated goals as well as current Social Security laws, rulings and formulas available from the Social Security Administration. Decisions regarding Social Security are highly personal and depend on a number of factors such as your health and family longevity, whether you plan to work in retirement, whether you have other income sources as well as your anticipated future financial needs and obligations.

-

Advisory Services provided by Voya Retirement Advisors, LLC (VRA). VRA is a member of the Voya Financial (Voya) family of companies. For more information, please read the Voya Retirement Advisors Disclosure Statement, Advisory Services Agreement and your plan’s Fact Sheet. These documents may be viewed online by accessing the advisory services link(s) through your plan’s web site. You may also request these from a VRA Investment Advisor Representative by calling your plan’s information line. Financial Engines Advisors L.L.C. (FEA) acts as a sub advisor for Voya Retirement Advisors, LLC. Financial Engines Advisors L.L.C. (FEA) is a federally registered investment advisor. Neither VRA nor FEA provides tax or legal advice. If you need tax advice, consult your accountant or if you need legal advice consult your lawyer. Future results are not guaranteed by VRA, FEA or any other party and past performance is no guarantee of future results. Edelman Financial Engines® is a registered trademark of Edelman Financial Engines, LLC. All other marks are the exclusive property of their respective owners. FEA and Edelman Financial Engines, L.L.C. are not members of the Voya family of companies. ©2024 Edelman Financial Engines, LLC. Used with permission.

-

IMPORTANT: The illustrations or other information generated by the calculators are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. This information does not serve, either directly or indirectly, as legal, financial or tax advice and you should always consult a qualified professional legal, financial and/or tax advisor when making decisions related to your individual tax situation.

The information contained on this website is intended to summarize at a high level some of the provisions under the Trinity Industries, Inc. 401(k) Plan (the “Plan”). It is not intended to provide a full description of the Plan. In the event of a conflict between the official Plan document and this website, the official Plan document is controlling.

Plan administrative services provided by Voya Institutional Plan Services, LLC (VIPS), a member of the Voya® family of companies.

© 2024 Voya Services Company. All rights reserved.